5+1 Growth Metrics 📈 Every SaaS Company Should Be Measuring 🚀

Recently I’ve been in touch with a number of CMOs from different growth companies and I asked them what’s the biggest pressing issue for them right now. They all had a common theme: what to measure and how to report it 🤷♂️

The truth is, we’re drowning in metrics 🌊 and this is affecting the performance of marketing teams, in a very negative way. Although digital tools have made the life of marketeers much easier, they have also introduced an overload of data that is dividing marketing leaders based on their opinion of what should be measured and what shouldn’t.

For instance, my friend Lari from a company called Sievo, posted this recently on his LinkedIn feed:

At the time of writing this article, he has had over 30 replies from different CMOs and marketing directors. Guess what → none of them agreed on what to measure 😕

Yet, if we look into truly successful SaaS companies 🦄 like Slack, Salesforce or Dropbox, they all have one thing in common: they track the growth metrics that matter the most. Here they are👇

1 — Net Annual Recurring Revenue (ARR)

ARR is the total recurring revenue you can forecast for the ongoing year, based on annual subscriptions that are expected to renew during the next 12 months ♻️

Put in a different way, ARR is an annualized version of the Monthly Recurring Revenue (MRR) representing the revenue in the calendar year 💰💰 Typically, early-stage investors will be looking at a healthy MRR (i.e., US$ 100k and above), whereas late-stage investors will be looking mostly at ARR (e.g., anything above US$ 10M).

Calculation

ARR = Revenue from subscriptions + Subscription Upsells — Revenue churned

2 — Subscription Churn (%)

Subscription Churn, sometimes referred to as “logo churn”, is the percentage (%) of customers who stop paying for your service during a certain period of time 📉

In order for a business to grow, the subscription churn has to be lower than the adoption rate. This metric is extremely helpful because it allows you to calculate one more fundamental health metric for your business: customer lifetime (not to confuse with customer lifetime value) — which is how long (in years) will customers stay in your service.

Calculation

3 — Gross Revenue Churn (%)

Out of all churn metrics, Gross Revenue Churn is by far the most important one for growth companies ☝️ It tells you how much money you are losing because of the loss of customers. In other words, when you lose a customer (subscription churn) you are also losing all the payments they are doing in your service 💸 That is Gross Revenue Churn.

Many SaaS companies obsess over measuring how many customers they churn, whereas they should be focusing on “are we losing the right or the wrong customers” — type of question. See these two examples 👇

Example 1 👉 You have 100 customers with a total revenue of US$ 3 million. Let’s say you lose 2 customers worth 20k each (so 40k in losses in total). Your subscription churn is 2% (2 out of 100 customers), and your Gross Revenue Churn= 1,3% (40k out of 3M).

Example 2 👉 You have 200 customers with a total revenue of US$ 8 million. Let’s say you lose 3 customers worth a total of US$ 890k. Your subscription churn is 1,5% (3 out of 200 customers), but your Gross Revenue Churn = 11,1% (890k out of 8M).

From the two examples above, it is clear that you should be more worried about Gross Revenue Churn, and this is why it is one of the main growth metrics for a SaaS business 🚀

Calculation

4 — Net Revenue Churn (%)

Net Revenue Churn is the percentage (%) of recurring revenue by which the ARR metric has grown or shrunk from already existing customers within a certain period of time. In other words, it tells you how much you are able to upsell and downsell within your existing accounts 📈

This metric is typically called “expansion”, because it tells you how much you expand your revenue from existing customers. Now here’s the trick: Net Revenue Churn is a percentage that can be either positive or negative. If the Net Revenue Churn is positive, it means that the ARR is shrinking due to churn or downselling. On the other hand, if the Net Revenue Churn is negative, it means that the ARR is growing because you are upselling the existing customers more than you are losing from churn or downselling 🤓

Therefore, negative net revenue churn is 👍 whereas positive net revenue churn is 👎

Calculation

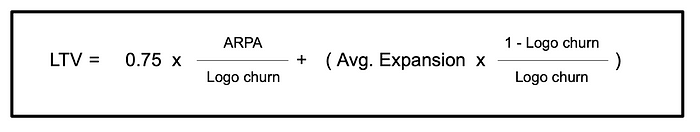

5 — Customer Lifetime Value (LTV)

LTV stands for Customer Lifetime Value, and it can also be named CLV or CLTV. This metric tells you how much revenue, on average, will a customer bring to your company over the entire span of time they’re buying your service. LTV is a vital metric 🌱 which, combined with the customer acquisition costs (CAC), can tell whether a business is sustainable or not in the long term.

For instance, if CAC is US$ 8,000, but the LTV is US$ 6,000, you can already see that you will lose $2k per customer. Typically, customer acquisition costs are dramatically lower than LTV, and that’s where businesses can get a margin to cover operational and capital expenses, as well as earning profits 💸

Making an accurate formula for LTV can be complicated, and every startup has to adapt the formula based on their business model, product distribution model and invoicing management. However, a general formula that is precise enough has to take into account Net Revenue Churn, and the fact that churn is a volatile metric (e.g., most SaaS businesses typically introduce a correction factor of 0,75 to obtain a more accurate LTV).

Calculation

+1 — CAC Payback Period

Want more? Here’s an extra one 👉 Only the most metric-savvy companies track Payback Period, yet it is a fundamentally important metric that can tell you, well in advance, whether you have to make adjustments or not in your business model. CAC Payback Period tells you how many months, on average, does it take for your company to recover from the CAC investment.

Unlike CAC and LTV, which form over long periods of time to give you an exact view of your business viability, CAC Payback Period can help you forecast how and when will your business model become unsustainable, so you can proactively make changes before it’s too late 🚀

In SaaS B2B companies, the payback period should preferably be under 6 months, in order to have a healthy business. 6–12 months means the business model is questionable and needs improvements. If the Payback Period is over 12 months, it means something is definitely wrong and you won’t be able to sustain the business at some point.

Calculation

Payback Period also relies on customer acquisition costs (CAC), which is the sum of all sales salaries, marketing salaries, sales expenses and marketing expenses.

Sources

Inside the Boardroom — A CMO’s Guide to Impressing Investors: https://www.hubspot.com/cmos-guide-to-impressing-investors

SaaS Metrics: VCs Share the 7 Key Metrics You Need to Track: https://www.geckoboard.com/blog/saas-metrics-vcs-share-key-metrics-track/

The Only Three Churn Calculations You Need to Know: https://chartio.com/blog/the-only-three-churn-calculations-you-need-to-know/

The Ultimate Guide to SaaS Customer Lifetime Value (LTV): https://blog.chartmogul.com/wp-content/uploads/2015/04/ChartMogul-Ultimate-Guide-to-SaaS-Customer-LTV.pdf

What is Annual Recurring Revenue (ARR) And How To Calculate It: https://www.priceintelligently.com/blog/arr

The Leaky Bucket, Net New ARR, and the SaaS Growth Efficiency Index: https://kellblog.com/2018/05/01/the-leaky-bucket-net-new-arr-and-the-saas-growth-efficiency-index/